is mortgage protection insurance expensive

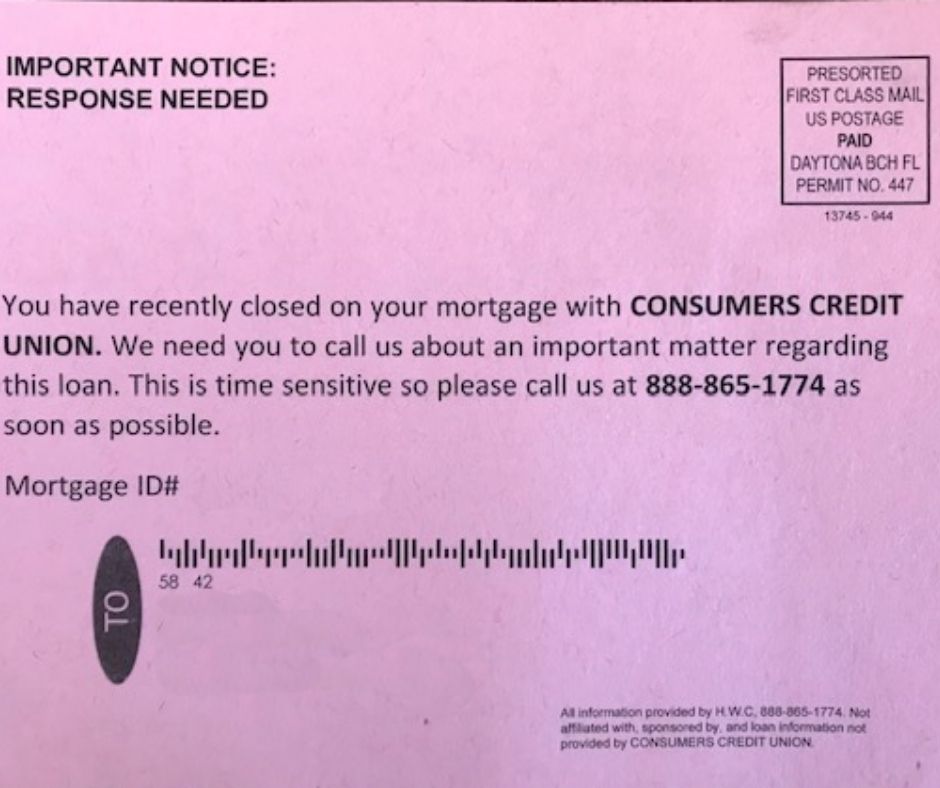

If you recently refinanced or bought your first home, you can expect to receive multiple offers from companies that sell mortgage protection insurance. Some of these offers may be frauds.

Most companies offering medically-underwritten level life insurance offer three or four non-tobacco underwriting classifications, ranging from Standard to Preferred Best. If you are in excellent health, the rate for Preferred Best Non-tobacco will be much less than Standard Non-tobacco. If you are a non-smoker, overweight, and taking medication for Hypertension (for example), you might qualify for the Standard Non-tobacco rate.

Several insurance firms are included in the list of companies informing you that you must safeguard your mortgage by acquiring the "mortgage assurance" policy. Homeowners often plea to assist their family members in staying at home in case they die suddenly.

Mortgage life insurance is more expensive than the guaranteed level of term insurance. It's generally offered as a "Non-Medical" insurance product. Non-medical means you're not required to undergo an examination (including urine and blood samples) to be eligible for coverage. The application process is made simple. It's quick and straightforward and only requires a small number of health-related questions. Mortgage Life Insurance is typically offered in just two categories: Standard Tobacco and Non-tobacco.

If you recently refinanced or bought your first home, you can expect to receive multiple offers from companies that sell mortgage protection insurance. Some of these offers may be frauds.

The good news is that the annoying mailers you receive are also accurate about the cost. It's generally quite affordable to buy $250k in Life insurance for a term (assuming you're in good health).

Be wary of offers asking for personal information such as social security numbers, bank account numbers, or credit card details. Most trustworthy companies will not request this data when they initially contact you to inquire if you want to buy mortgage insurance to protect you from the mortgage.

Watch out for offers asking for sensitive information like your social security number, bank account number, or credit card information. Most reputable companies will never ask for that information when they first reach out to you to see if you are interested in mortgage protection insurance.

It's a good idea for everyone with a family dependent on their income to have a term life insurance policy. And that's what mortgage protection insurance policies are.

It is unpleasant to be bombarded with offers for the exact product, mainly when the advice can be somewhat confusing. But, the majority of people are not adequately covered in the area of life insurance. The mailer recommendations are a reminder - warning you of the need for insurance. The prospect of taking on a significant credit card should prompt you to reconsider your life insurance.

Is mortgage protection insurance tax deductible?

No. Typically, mortgage protection life insurance premiums are not tax deductible.

PMI is typically required on a conventional mortgage if your down payment is less than 20 percent of the home's value. Mortgage protection insurance, on the other hand, is entirely optional.